Dear Friends,

In this post I contrast the mapping of a life system with a journey map. You see very different things when change the lens you use to study your customer. Enjoy!

A Life System is Not a Journey

Companies have become accustomed to thinking about their customers’ experience with their solution as a journey. A journey is one way of seeing how the customer experiences things. It’s a linear way of describing the sequence of events that are most likely to occur. There is nothing wrong with journey mapping. It’s a powerful way to think about the impact your business model has on the customer.

But it’s only one lens.

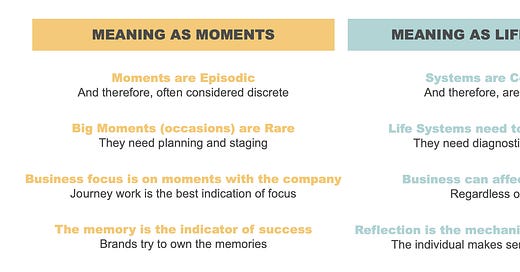

Life systems are another, more integrated, way of seeing the customer’s experience. Let’s compare the journey thinking to system thinking. As I mentioned earlier, journey work is about managing moments. We are used to designing for moments today. Twenty years ago, most companies didn’t know how to think strategically about moments. When design thinkers introduced journey maps and data to support the redesign of key moments in the experience, executives started to pay attention.

To create meaning for customers through moments is to identify discrete time sequences and either wait for the customer show up or encourage them to show up. First, the customer should do this. Then the customer should do this. And so forth. Like in a well-scripted show, a journey experience can be a wonderful experience, if the company knows how to build anticipation, surprise and delight, and make the time value high. By doing so, the experience becomes memorable. The customer upon reflection decides that the sequence of events have significance.

When a company creates meaningful experiences through life systems, the solutioning helps the customer create their own moments, their own meaning, and a better life. It is the customer who sets up the activities that will be ongoing. The company creates solutions that fit within the systems that the customer produces. That means the company can do things that it cannot do in a moment. They don’t have to wait for the right moment to create meaning. They can diagnose and adjust. They can sense and respond. And companies can encourage the customer to reflect on their life system. When people reflect on their life systems, they almost always create meaning while improving their lives.

Let’s take a look at the three most important life systems:

· Health and Wellbeing

· Money Management

· Family Togetherness

Health and Wellbeing Life Systems

When we talk to people about their systems for managing health and wellbeing, they describe a dynamic requires a significant amount of decision-making. For many there are negative patterns that work against their wellbeing. When they think about health and wellbeing they often ignore their own best advice. These people tend to have as a part of their life system negative self-talk, which literally helps them talk themselves out of wellbeing. Almost all people we met with had some sort of mental list they tried to keep track off. The list isn’t very helpful. But at least it keeps them somewhat engaged.

Those who have been intentional about their health and wellbeing, have additional elements in their life systems. They talk about patterns and tools they deploy to help them take ownership and elevate the importance of things that are on their list. They create activities that increase their awareness, improve their mindset, and increase their conscious decision making.

These invested life system people have tools that increase positive self-talk, which improves motivation and will power. They create barriers to things that are not on their list. They create routines and modes that keep them in the game. They track their progress, which makes them feel more confident.

They are never 100% about staying motivated. They don’t need to be. Their system will kick in to support them through times when motivation is low or circumstances are challenging. This ‘map’ shows opportunity areas for companies to support customer health and wellbeing. It’s not a journey, or linear representation of the customers’ experience. It functions more like a topical plan, showing the relationships between opportunities and activities.

Money Management Life System

Companies are used to the idea that people have systems for money movement. What other reason would there be for so many fintech solutions? For decades we’ve worked with banks. I remember years ago when our clients would ask us why their customers didn’t consolidate all of their accounts with one bank. We asked their customers and they gave legitimate reason: distrust of the financial institution, better deals on new accounts, and intentional money management were a few of the reasons.

Today, most financial organizations understand the third reason: intentional money management. They get that people hire financial tools to help them accomplish short term and long-term goals. They recognize that cash management and cash flow are key jobs to be done. Money moves. People feel like they have a healthy financial life if their money is where they need it, when they need it, and how they need it. They see money management as a system of inputs, outputs, feedback loops, alerts, and tools. (Traditionally banks haven’t understood personal money management as a system, believing instead that money belongs in an account and that a check or debit card is a ‘withdraw’ from the money storage solution they provide.)

People separate their money systems into two ‘views.’ Their micro view focuses on their daily life. They deploy tools and processes to help them move money while holding themselves accountable their purchases. Within daily life there are three types of financial activities: predictable ones, unpredictable ones, and momentary activities. Their macro view is for longer term planning and longer-term goals. The activities typically occur around life events, some of which are planned and some of which are unexpected. But more successful people set up systems to ensure that they check in on their macro view with greater frequency. Regardless, the tools and resources they deploy are used episodically.

Additionally, people have money buckets that they manage. These are intentional activities that they fund, often setting up the buckets so that some are easy to get to and others have barriers. They track their activity. Some are more successful at tracking but most has some sort of a dashboard. And last, the successful ones reflect on their money management system. They derive meaning from their success and they learn from their failures.

When a new tool, process, or solution is introduced into their money management system, there is a discovery phase. During the discovery phase, every part of their money management system becomes more ‘visible’ to the individuals involved. They evaluate how the new solution affects the other parts of their money management.

Family Togetherness Life Systems

People have systems for creating family togetherness. Their systems are as varied as the people in the family. I’m using the word ‘family’ loosely. Today people define for themselves who is in their inner circle. Families come in all shapes and sizes. But there are certain things that most families do to build connection, celebrate, and strengthen one another. They try to be mindful and empathetic. In one study we conducted, people said that family togetherness is a life system they most want to improve. They shared their strategies:

· Set up a family group chat

· Keep a calendar

· Focus on the little things

· Have a belief system

· Create a sense of awe and wonder

· Get feedback

· Make decisions democratically – this one was particularly true for families with teens

Many people felt they had low functioning family togetherness. They wanted a better life system. In fact, a number of people thanked us for asking questions about their family systems. They determined to be more intentional about the design of their life systems.

You can survey your customers around any life system. You can understand what is important to them. You can design solutions that improve the intangibles of quotidian life. And the companies that do so create lasting ‘relationships’ (is that the right word? Or should it be ‘dynamics’?) that customers value.

More on dynamics in my next post.

To be continue …