Adjusting Your TWS Metric to Your Company’s Situational Needs

Chapter Five: Principle 4—Value is in Time Spent

Dear Friends,

Please share this latest post from the Experience Strategy book! Chapter 5 is almost finished!

Adjusting Your TWS Metric to Your Company’s Situational Needs

In my last post, I shared three questions that can be used to create an almost universal index of time value. Almost. There are certain situations where each of the questions are not appropriate, which is also true for CSat and NPS. For example, you might not want to ask, ‘how enjoyable was the experience for you?’ after a colonoscopy. Right? I mean, how do you interpret the answers?

You will notice that I referred to three TWS questions as starting point questions. That’s purposeful. When Fred Reichheld introduced NPS, he said that his question was the only questions that companies would ever need to ask. He imagined it to be a universal question.

The TWS approach is different. We start with questions that are easy to understand and apply. But then we recommend you customize your questions to the experience you want to improve. This is right. This is how things should be measured, based on the purpose and goals of the experience itself.

But how is that manageable you ask? How can the whole organization get behind specific questions for specific experiences? The answer is so simple that you might miss the beauty of it.

What companies need is a unifying way to write questions. “Don’t you mean, a unifying way of asking questions?” No, I don’t. What creates the ability to quickly review survey responses is familiarity with the question type, not the fact that the same question is asked over and over again. Nor do we need to solely rely one tool for always asking the same question. So what the company needs is rules for how to write the question itself.

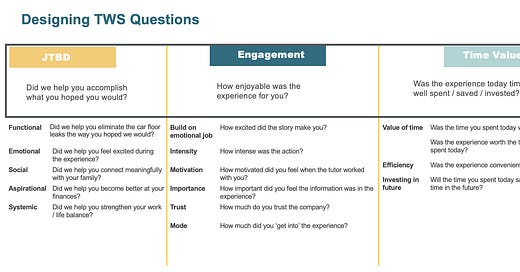

For example, we recommend that all questions written about the job to be done start with the phrase “Did we help you …” Why? Because ‘did we help you’ signals to both the customer and the employee that there was a job to be done. Once you have that starting point language you can adjust the rest of the question to fit type of job you want to measure. Here are some sample questions:

Let’s keep going. When it comes to understanding engagement what companies need to understand is how much engagement the customer is having with the experience. Therefore the way to write an engagement question is to start each question with ‘how.’ For example,

Notice the top question. Engagement is almost always associated with emotion. So, if you want to build in a second question that gets at an emotional job to be done, you can. That creates an opportunity for you to use job to be done question for something functional, social, aspirational, or systemic. But note also that you are measuring something different: how engaged the customer is by means of emotions.

Notice also that there are different types of engagement. The list provided is not a complete list. You can track trust, importance, motivation, and modes. So if the starting point question—how enjoyable was the experience for you?—isn’t appropriate, think first about what type of engagement you want the customer to have with the company and create a ‘how’ question.

The third question, as you remember, focuses on time value. While the starting point question works for most situations, a company may want to get more specific. Here’s the starting point question: Was the experience today time well spent / saved / invested? And here are some additional questions that we’ve tested and found to be useful:

Because the company is focusing on time value, we recommend that you almost always start the question with a past, present, or future tense form of ‘to be’ accompanied with the word ‘time.’ These clues not only help the customer to understand what is being ask, but the also help the company to understand the purpose of the question.

When you identify three unique, well-written questions that are appropriate for the situation you want to measure, you create a unique but comparable index. Even though the questions are different, the index is similar enough to other TWS indices that a company can compare the results. Thus the questions for the call center don’t have to be exactly the same as the questions for the online video platform.

For some companies there’s a need to maintain an NPS question in the mix. They want one unifying question and they have historical trends that they want to compare to. That’s fine. Keep it as an observable impact/action question. You don’t need to include it in the TWS index. It becomes the plus one I describe in the previous post. Here are some examples of observable impact/action questions you might consider creating.

To be continue …