How Your Company’s Point of View Helps You Innovate

Chapter Three: Principle 2—To Be Compelling Requires a Strategic Point of View

Dear Friends,

Today is a payoff day. You’ve been reading chapter three and feeling good about the content, but you wonder how you are going to get senior leadership to buy into creating a point of view statement, I believe this post will help you make the case.

As always, the outline is at the end of the post. And please, please share this with someone who needs to read it.

How Your Company’s Point of View Helps You Innovate

A mission statement explains the purpose of the company. A vision statement describes the long-term results of your company’s efforts. A strategic point of view statement describes a future oriented need of customers that will create growth, if your business model can be designed to support the need. Thus, a point of view statement has a direct impact on how a company innovates.

When most companies of any size today innovate, they don’t build everything inhouse. In fact, that would be crazy. What innovation today looks like for most companies is more like orchestrating a solution using partnerships, SAAS solutions, platforms, and other sources. That means that most companies are dependent on new technologies for their innovations to work.

They often don’t know what new technologies are going to be important and spend time and capital on a wide variety of platforms and providers who do not have the same objective. Innovations that are first to market and solve the customer’s needs better have a huge financial payoff for the company. Startups, who almost always have a point of view about the future needs of customers, are more effective than mature companies at orchestrating solutions that show massive returns.

Investors know the power of POVs and often beg startups with a powerful point of view about a future customer need to take their money—even if the company doesn’t yet have a solution. The research and advisory group, Gartner, created a framework to track the expectations of technologies so that strategists can discern between hype and product maturity, precisely because the startup and investor community tend to exaggerate either the customer need or the product’s ability to perform.

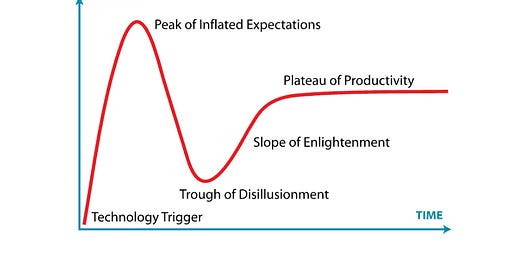

Gartner’s framework is called the Hype Cycle. It tracks how an innovation moves along an S-curve toward maturity.

The Gartner Hype Cycle

Most innovations, according to Gartner, follow a similar trajectory. There is some kind of technology trigger that makes new solutions possible. Think: proof that generative AI will work for the masses. Investors and future customers get excited about the potential and set expectations that far exceed the current technology’s abilities. The technology continues to improve but doesn’t deliver in the near term. So the market for the technology drops to almost nothing. Most customers and investors step away.

But the companies who create the technology keep innovating (and spending investor money) and eventually someone learns how to build a solution that, though never reaching ‘the peak of inflated expectations,’ provides a viable offering that does catch on and yields high returns for the solution provider. Gartner calls that point in the product development, ‘the plateau of productivity.’ Another way to describe what going on is that a market has been established for the solution, and likely is consolidating around a few providers. Everyone else is eliminated and most companies tap into the few solution providers because they become standard.

Thousands of new startups fit into this model every year. Every year there are winners and losers. And every year, the innovation teams in large organizations must adjust their roadmaps based on who is winning in the hype cycle.

The Gartner Hype Cycle is a powerful framework that helps many companies every year make better decisions. When a company combines an understanding of new technologies prospects with their own point of view, innovators within the organization can move faster and leaders can make better decisions. Here’s an approach that works.

First, the company establishes their point of view statement. Then, they use that point of view statement to help them make decisions about which technologies to pay attention to, when is the right time to build, and how to create something that is new and compelling.

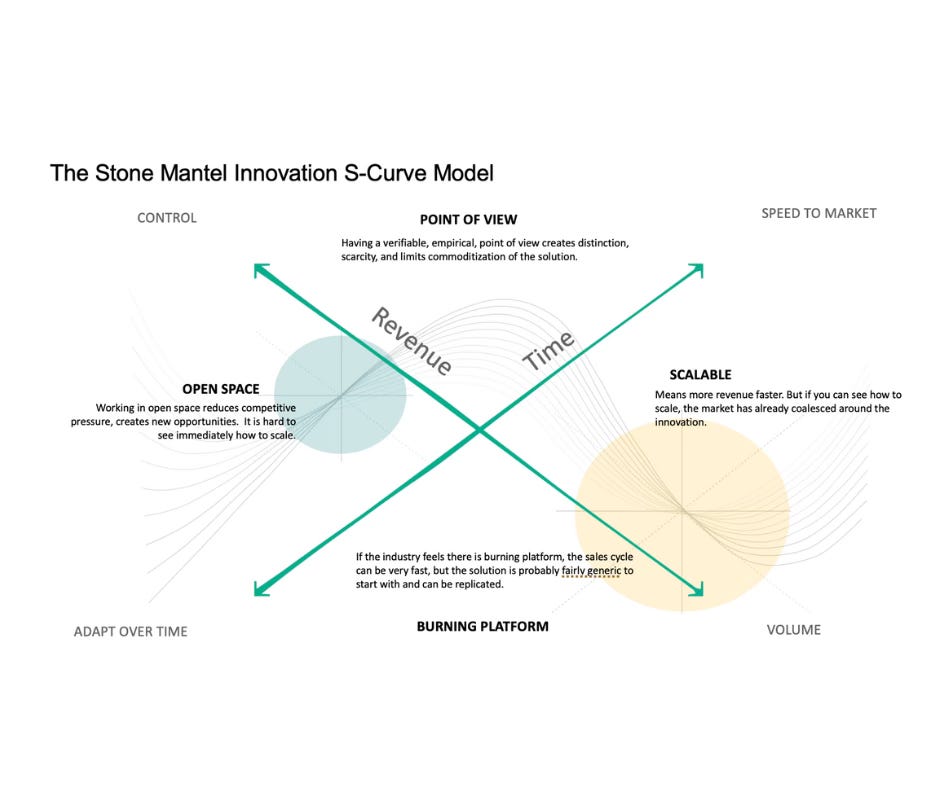

A more visual way of describing what happens when a company applies its point of view statement to the winding path of new technologies is below. It may need some explaining. It’s not the most intuitive framework but it’s definitely one of our most successful models.

Time and revenue are factors in almost every innovation that companies introduce. And those factors can work for or against a company. For revenue, a company can charge whatever it wants for an innovation, as long as there are no competitors. But once a market is established with competitors and standardizations, the best hope that a company has for revenue growth is to be able sell as many solutions as possible. Think about Tesla. When it was the only EV company, it could set its own prices and control its revenue effectively. But as a market developed for EVs and more companies created solutions, Tesla’s only real strategy for growth was to increase volume. Thus, in most cases, companies can control their revenue from truly new innovations. They get to set the price. But over time, they lose control and are almost always forced to generate greater volume of sales. The innovation becomes a commodity.

For the time axis, the company’s continuum is adaptability versus speed to market. If a market is not yet present for a solution, the company has time to adapt their solution to customer needs. They can play with things. They can afford greater risks. But once a market is established for the innovation, things speed up. The company can no longer adjust and adapt. They must be fast and fast requires them to use ready-made solutions. Ready-made solutions are easily adopted by competitors. So the company loses the ability to make the experience distinct. Commoditization quickly ensues.

That’s layer one of this framework: two continuums that describe the opportunities and constraints most companies experience before and after a market is established.

Layer two: The S curve. Our S curve is a little more exciting than Gartner’s but it serves the same purpose. It shows a path through the cycles of innovation. Most true innovations start in what we might call open space. The company can imagine the innovation. The company may be able to find parts to build elements of the innovation, but the innovation is not fully realizable. And therefore, there is no market.

In fact, most companies can see the possibility of the innovation, they just don’t know what to do with it. The people who brought us generative AI talked about generative AI long before it became viable. Companies paid attention but they didn’t know what exactly to do with it. Now a market has been established and everyone without a point of view sees the innovation as a burning platform. It’s very hard to get value out of a burning platform innovation. As of today, generative AI is no longer in open space. It’s now moving toward scalability, which is what most technologies do after a market is developed.

Now, here’s where a point of view makes a difference. For the company who has a point of view, when they see things developing in open space, they can begin to imagine how they will implement the technology to support their point of view. They can be ready. They can help to shape the technology to their wishes. And their path through the growth cycle is different. They have more control, they don’t need to scale quite as fast, yet they also can act faster and take advantage of speed to market. They are able to withstand the pressures of commodification longer. Tesla has all of those advantages over Ford, GM, or anyone else. They had the point of view. They built the market. And even though the market is not nearly as a profitable now as it was a few years ago, they get most of the gains.

For those who do not have a point of view, the path to commodification is more straight, narrow, reactive, and lacking in value for the company. They have to adopt the standards and practices of everyone else because the market requires them to. And they don’t have time or revenue control. And, unfortunately, they get marginal value from their efforts to innovate.

Having a point of view gives large companies—and small companies—the ability to maximize the value of the innovation.

To be continued …