The Thing that Blinds Companies from Seeing Situational Markets

Chapter 2: Principle 1—Growth comes by Capturing Situational Markets

Friends,

Chapter two of The Experience Strategy book is coming along nicely and this is the first installment. At the end of this section I include the outline for chapter two and the outline for chapter one with links to the sections.

I very much would like your feedback so please comment. And a challenge: please share this post with three people within your circle who need to read this section. Encourage them to subscribe.

Chapter Two Objective

Your company has a business model. And unlike many business models of yesteryear, your company understands how important it is to be customer focused. My goal for this chapter is to provide you with a principle that will turn your business model into a growth model. Growth comes from creating value for customers. Yet, we live in a time of abundance. People today have access to almost everything they need, instantly. How does a company grow today? And what role does experience strategy play in a company’s growth?

Chapter Summary

Market strategy today and tomorrow should focus on aggregating the situational needs of individuals.

Developing a strategy for situational markets requires an assessment of your data and your analytical tools

Situations change so the strategist needs to adapt their models over time

The new strategy skill: Identifying growth markets from common and unique situations

The Endless Opportunities Derived from Situations

In chapter one, I asked if you were in the photo taking business, which business model would you rather have: Cannon’s or Apple’s? Cannon’s is based on the idea that cameras are for people who want to take photos. Apple’s business model is based on the idea that when a photo taking situation arises, anyone should be able to do so immediately.

We all know that smart phones do far more than photo capture. But strategists haven’t understood the strategic implications of intelligent tools. Before intelligent tools, people had to go places to get things done. That means they had to leave whatever they were doing to go do something else. Now they can make the most out of any situation that they find themselves in.

Want to go camping in the mountains and watch Netflix? Starlink has a solution for you.

Want to visit the doctor without rescheduling your golf game? Remote clinic visits let you do both.

Want to write a novel and keep your day job? ChatGPT can help.

Want to kiss your husband while driving? Telsa autopilot will take over the controls.

You get the idea.

Intelligent tools create personal data ecosystems that empower individuals to take control of their situations. That’s where the value is created today. All companies today, regardless of whether or not they are software providers, must address the power that these technologies provide for people.

Those who can empower people whenever the situation arises are the companies that will grow. In the past it made sense for companies like Canon to target people who love to take photos as a segment for their growth—because they would be the ones to leave their homes and drive to a store and buy a camera.

Canon has largely exited consumer markets and retrenched to B2B industries. Eventually B2B markets will also behave as consumer markets do. A quick review of their website shows that they cannot see situational opportunities because they don’t see the market opportunity. Canon, like all old school businesses, has chosen to see a ‘market’ as an industry category. They are in ‘imaging,’ ‘medical,’ ‘industrial,’ and ‘printing.’ These industrial categories are safe places to hide out while the whole world is literally being transformed by always on cameras made by other companies for common situations.

Here are the numbers. The market for digital cameras has been growing at a rate of 5.25 percent annually, with something like 133 million devices sold each year (Statista Research Department, 2024). While Canon has 46 percent of the professional camera market, they sell less than 3 million digital cameras per year. That’s a massive gap.

What Canon should be doing is targeting common situations where a camera is a perfect tool for the moment. From personal surveillance for homes to videoblogging to personal-high-resolution-body imaging, there are a vast array of solutions that require Canon’s expertise.

The Thing that Blinds Companies from Seeing Situational Markets

For many, this will be the most controversial thing I will say in this book.

The foremost thing that blinds companies from seeing situational markets is persona-based segmentation.

Why didn’t Sony create the iPod? They were the monster success company of the 80s and 90s. They had all the resources. According to John Kay, it was because of competing divisions within Sony who were looking for ‘market’ share (Kay, 2012), which was defined at the time by persona segmentation. The Walkman market was segmented into ever smaller demographic-based segments.

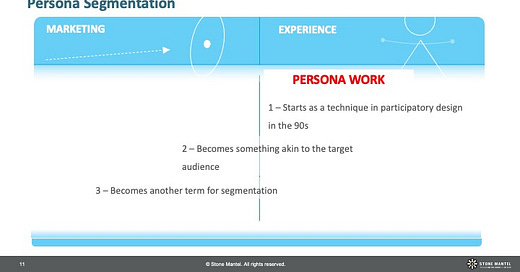

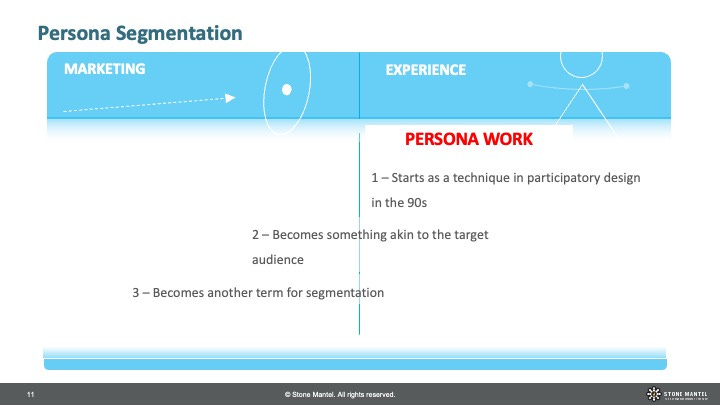

I use the term persona segmentation purposefully. What has happened since the 90s is the merger of marketing segmentation (which may have an important role to play in messaging) with the design thinking persona work (which was meant to help designers imagine the everyday needs of users). Marketing strategy isn’t the same as experience strategy. In chapter three I will explore in more detail the differences but for now let’s narrow the differences down to this: marketing sees markets as the ‘who’ and experience strategy sees markets as the ‘what.’

Persona design (the design thinking version) originally focused on describing the functional and emotional needs of a typical user. But over time persona work has morphed into segmentation work. In doing so, it has become a marketing tool rather than an experience strategy tool.

How Sony Gets Disrupted

Steve Jobs, the Mr. Moriota, of his time, destroyed the markets that Mr. Moriota’s Harvard-trained MBAs created.

Mr. Moriota was the chairman of Sony. He showed tremendous vision and leadership in the 80s by identifying the job that consumers wanted done: portable music. And he spearheaded the development of the Walkman. The company grew into a juggernaut. But then the MBAs he hired took over growing the business model and turned a near universal need—portable music—into persona-based segments to be targeted. There was the girl market, the boy market, the adult market, and on and on. The same was true for Sony records. There were different persona-based segments for Sony records. And each part of Sony was focused on growing their market share by more narrowly defining the demographics and psychographics of the intended audience.

The divisions between departments, reinforced by how they saw markets, made it impossible for the teams to collaborate. They felt like competitors rather than collaborators. That’s exactly what Canon is doing today. And that’s exactly what most companies still try to do. They create fiefdoms around ever narrower pre-defined feature sets, driven by the wrong types of aggregated insights.

Another more example. Historically, the most successful company to use persona segmentation was Procter & Gamble. More than any other company, Procter & Gamble invented market segmentation. And during the 60s through the 00s they were wildly successful. They created blockbuster brands like Tide, Olay, Pampers, Crest, Bounce, Old Spice, and on and on. Many great marketers learned their craft as brand managers at P&G and then went on to lead marketing for other great companies. Cream of the crop!

In 2002, P&G was a client of mine. Joe Pine, co-author of The Experience Economy and I were brought in by the company to help them think about extending their brands to physical experiences. If you’ve ever been to a Tide-branded drycleaner store, you get what P&G was trying to do. They wanted to use place-based services and experiences to create even more visibility and loyalty for their brands.

I remember sitting in a working session focused on a skin care product with great brand recognition. The R&D people had come up with a new serum that was remarkable. It would make the product much better. The company had decided to create a brand extension for the product. That meant that the current product on the shelf would become a basic offering and the new serum would become a premium offering. It seemed like a smart business move.

But before the brand manager could roll out the new serum, she had to demonstrate to her leaders that there was a market for the improved formula, one that would not ‘cannibalize’—the same word the Sony MBAs used to argue against an iPod-like device—the base product’s market. P&G’s methodology for establishing a product’s market was similar to Sony’s. The brand manager needed to find people who would pay a premium for the new serum but were distinct from the group who were already buying the base product. No cannibalization of the people who were already buying the original product.

Does this sound familiar?

The brand manager was successful. She found a narrow sliver of women who have a certain income and preferences for premium skin care products—and who weren’t base product brand fans. So the product launched.

And the people who bought the product didn’t look anything like the persona-based segmentation created by the statisticians at P&G. They were almost all people who just wanted the better serum. They came from all walks of life. Many had used the base product and wanted to upgrade.

With almost 80 branded products, P&G has a market conundrum (as does Marriott, Coca-Cola, and Kohler). How do they create new markets when there are only so many people to target using persona segmentation? If every time they create a product extension they have to create new people categories to prove there is a market, they are in trouble.

Ironically, at the exact same time I was working with P&G so was Clayton Christensen (or at least his team), the late professor of innovation who revolutionized the way I and many others think about markets. Together, Christensen and P&G worked on a new product: The Swiffer. The Swiffer became a disruptive innovation in its category. The market for the Swiffer grew dramatically. It was an overnight best seller.

And it never had a persona-based segment marketing plan. Christensen was against it. He’d watched how Sony lost their way with Walkman. He felt that the company should focus on the big job to be done. And he was right.

Chapter 2 Outline:

Chapter objective

Summary of chapter

Introduction

When it comes to business models for taking pictures, which market do you want to be in: Apple’s or Canon’s?

What Clayton Christensen meant by the milkshake example.

What Markets Should Look Like Today

Experience strategy is about individuals, not segments

Situations can be aggregated, just like segments

The opportunity for growth is endless

Developing a Strategy for Situational Markets

Assessing your data and insights

Discovering new market opportunities

Defining your strategy

Closing the gap between your capabilities and the situational market

Developing the Analytical Tools to Evaluate Your Strategy

Aggregating situational data

Balancing between individual preferences and common situations

Situations Change

Experience designers almost always design for the ideal and the permanent

But people’s lives are constantly changing

Strategists need tools that address changes in people’s situations

The customer SWOT analysis helps companies do scenario planning for their customers.

New Strategy Skill: Identifying Situational Growth Markets

There is untapped demand created daily in situations

Strategists must develop the tools to identify that demand and immediately respond

Requires new paradigms for value creation, new capabilities, and new analytics

Closing

Click here for book outline with links to posts

This post about Experience Strategy Certification is also helpful.

That's a really good point, Steve. I think there are two opportunities: one is to find situations with staying power. The other is to maximize revenue from transitory situations. Both require a kind of scalability that most companies, certainly not Peloton, don't currently have.

I me, Peloton over invested in a trend, not situation. A situation, in my humble opinion, is the reasoning. A trend is constrained by time, while a situation is a state or a recurring state. Just as holiday displays are situational and spur holiday shopping due to their recurring state that affects humans emotionally.

Peloton played a trend like a state.

Tesla has done the same.

EVs may be trending, but the situation isn’t sticking. That’s why 50% of ev buyers now want to trade in for a gas.

Someone like Jobs, Disney, etc. are masters at looking past trends and seeing the new states.

Literally visionary!